How To Create A DeFi App? A Guide For DeFi App Development

- Nundini Khanna

![Nundini Khanna]()

- Web Development

- Last updated on

What are defi app development?

DeFi apps are decentralized finance apps that can created by defi app development and have their place in the crypto world along with creating traction worldwide. It is a secure financial technology based on secure distributed ledgers which are used in the case of cryptocurrencies too.

Centralised financial institutions are being challenged by DeFi apps and promote peer-to-peer digital exchanges.

The concept of secure digital wallets eliminates the fees that the bank and other companies charge for using their services. Funds can be transferred in minutes without and DeFi also doesn’t require any internet connection to function smoothly. The main agenda to create DeFi platforms is to eliminate the third party platforms and the system of centralised institutions from financial transactions.

Stablecoins, softwares and hardwares enables the development of DeFi applications.

Centralised apps vs Decentralised apps

Centralised apps and decentralised finance (DeFi) apps differ in several key ways:

- Centralization vs Decentralization: Centralised apps rely on a central authority or intermediary to control and manage the platform and its users' data and assets. DeFi apps, on the other hand, are built on blockchain technology and are decentralised, meaning that there is no central authority controlling the platform.

- Transparency: Centralised apps often have opaque internal workings and decision-making processes, while DeFi apps are built on open-source technology and are transparent by design.

- Trust: Centralised apps rely on trust in a central authority to secure and manage users' data and assets. DeFi apps, on the other hand, rely on the trustless nature of blockchain technology and smart contracts to secure and manage users' data and assets.

- Accessibility: Centralised apps often have strict verification and KYC (Know Your Customer) processes, while DeFi apps often allow for more accessible and anonymous participation.

- Censorship resistance: Centralised apps are often subject to censorship and control by the central authority, while DeFi apps are built on a decentralised infrastructure that is resistant to censorship.

In summary, Centralised apps rely on a central authority, while DeFi apps rely on blockchain technology and smart contracts to provide a more open, transparent, and accessible financial system. But, DeFi apps may also come with a greater degree of risk.

Types of DeFi apps available in the market:

There are several types of DeFi apps, some of the most popular ones include:

- Lending and borrowing platforms: These platforms allow users to lend and borrow cryptocurrency and other digital assets in a decentralised and trustless manner.

- Decentralised exchanges (DEXs): DEXs are decentralised marketplaces for buying and selling cryptocurrencies without the need for a central authority.

- Stablecoins: These are digital assets pegged to the value of a fiat currency, such as the US dollar, to reduce volatility.

- Yield farming: A form of earning interest on digital assets through liquidity provision or staking.

- Insurance: Platforms that allow users to purchase insurance for their digital assets.

- Predictions markets: Platforms that allow users to place bets on the outcome of events, such as election results.

- Identity and reputation systems: Platforms that allow users to establish and verify their identities and reputations in a decentralised manner.

These are some of the examples of the many types of DeFi apps that exist, but the space is constantly evolving and new use cases and possibilities are emerging.

Key components of DeFi apps

Given below are the components and the services provided by the DeFi apps:

- Decentralisation: DeFi apps are built on blockchain technology and are decentralised, meaning that there is no central authority controlling the platform.

- Smart contracts: DeFi apps use smart contracts to automate and enforce the terms of agreements between parties. Smart contracts allow for trustless and transparent execution of financial transactions.

- Cryptocurrency: DeFi apps often use cryptocurrency as a means of exchange and store of value, allowing for fast and low-cost transactions.

- Transparency: DeFi apps are built on open-source technology and are transparent by design, allowing for easy auditing and verification of the platform's workings.

- Accessibility: DeFi apps often allow for more accessible and anonymous participation, without the need for traditional financial intermediaries like banks.

- Permissionless: DeFi apps don't require permission to access or use, anyone can participate in the network, it's open to everyone.

- Censorship resistance: DeFi apps are built on a decentralised infrastructure that is resistant to censorship, allowing users to have full control of their funds and transactions.

- Interoperability: DeFi apps often have interfaces that allow them to interact and connect with other DeFi apps, creating a broader ecosystem of financial services.

These are some of the basic key features of DeFi apps, but the space is constantly evolving and new features and possibilities are emerging in the wider crypto world.

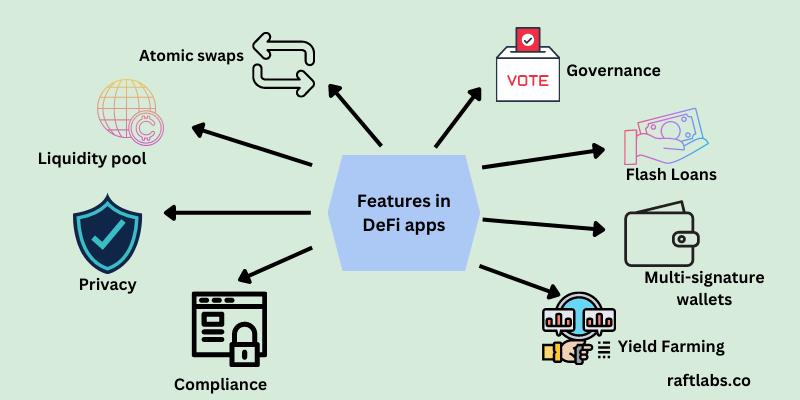

Some must-have features in DeFi apps

Some important features that are commonly included in DeFi apps include:

- Liquidity pools: Platforms that allow users to provide liquidity to a pool of assets in exchange for a share of the trading fees.

- Atomic swaps: This allows users to exchange one cryptocurrency for another without the need for a centralized exchange.

- Governance: Community members can vote on proposals to improve the platform and its underlying protocols.

- Flash loans: Allows users to borrow assets for a very short period, usually a few minutes, without collateral.

- Multi-signature wallets: A feature that allows for multiple signatures to be required for transactions to be executed, providing an extra layer of security.

- Yield farming: Users can earn interest on their digital assets through liquidity provision or staking.

- Compliance: A feature that allows for compliance with regulations and laws by implementing KYC and AML procedures.

- Instant exchange: A feature that allows users to exchange one cryptocurrency for another without the need for an order book, it's done through a smart contract.

- Privacy: A feature that allows users to keep their transaction and personal information private, it can be done by using zero-knowledge proof or privacy coins.

These are some of the important features commonly included in DeFi apps, but it is important to note that not all DeFi apps have all these features and new features are constantly being developed.

How do DeFi apps work?

DeFi apps, or decentralised finance apps, work by using blockchain technology and smart contracts to provide financial services in a decentralised manner. Here's a general overview of how DeFi apps work:

- A user interacts with the DeFi app through a digital wallet, such as MetaMask or Trust Wallet, which is used to store their cryptocurrency and interact with the app's smart contract.

- The smart contract is a set of rules and instructions that are stored on the blockchain and automatically executed when certain conditions are met.

- The DeFi app's smart contract interacts with other smart contracts on the blockchain to access or provide liquidity, execute trades, or facilitate loans.

- The DeFi app's smart contract also interacts with decentralised oracles, which are used to fetch external data, such as price feeds, to be used in the execution of the smart contract.

- When a user initiates a transaction, such as borrowing or lending cryptocurrency, the smart contract automatically executes the transaction and updates the user's balance accordingly.

- The DeFi app's smart contract also records all transactions on the blockchain, providing a transparent and auditable record of all actions taken on the platform.

- Some DeFi apps also have a governance mechanism, where the community can vote on proposals for updating or improving the platform and its underlying protocols.

DeFi apps are built on open-source technology, providing transparency and trust in the platform. These apps can be built on different blockchain networks, like Ethereum, Binance Smart Chain, and more. They offer a more open and accessible financial system, but there's also a potential for higher risk.

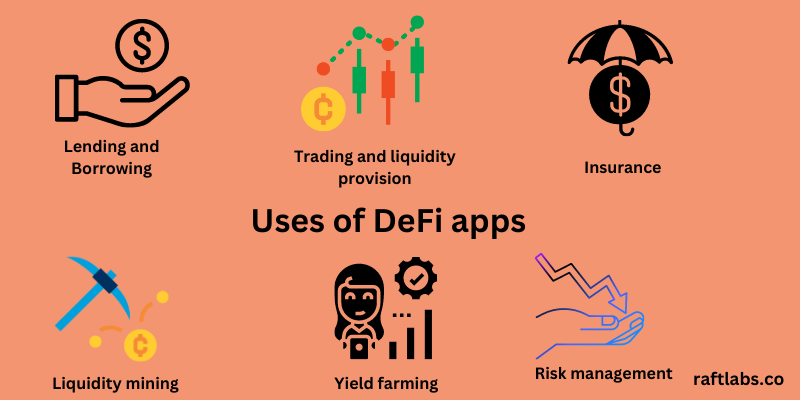

Uses of DeFi apps

Decentralised finance (DeFi) apps can be used for a variety of purposes, including:

Lending and borrowing: Users can lend or borrow assets using smart contracts on the blockchain, often with low or no fees and without the need for intermediaries such as banks.

Here are the top 5 DeFi apps that support lending and borrowing:

Aave: A decentralised money market platform that allows users to earn interest on their deposits and borrow assets.

Compound: An automated money market protocol that allows users to earn interest on their deposits and borrow assets.

MakerDAO: This platform enables users to borrow DAI, a stablecoin pegged to the US dollar, by locking up collateral in the form of ETH.

dYdX: This exchange is decentralised and offers margin trading, lending, and borrowing.

Nexus Mutual: This is an insurance platform that allows users to earn interest on their deposits and take out coverage for smart contract risks.

Trading and liquidity provision: Users can trade cryptocurrencies and other assets on decentralised exchanges (DEXs) using smart contracts, and can also provide liquidity to these exchanges to earn trading fees.

Uniswap: This exchange enables users to trade cryptocurrencies and tokens in a decentralised manner.

Aave: A lending platform that allows users to earn interest on their crypto assets by lending them to borrowers.

MakerDAO: A platform that allows users to take out loans using their cryptocurrencies as collateral.

Compound: A lending and borrowing platform where users can earn interest on their crypto assets or borrow against them.

Curve: an exchange that focuses on providing stablecoin liquidity.

Stablecoins: Users can use stablecoins, which are cryptocurrencies pegged to the value of real-world assets such as the US dollar, to reduce the volatility of their investments.

MakerDAO: A decentralised platform that allows users to take out loans using their cryptocurrencies as collateral, with the Dai stablecoin being used as the loan currency.

Compound: A lending and borrowing platform where users can earn interest on their crypto assets or borrow against them using stablecoins.

Aave: A lending platform that allows users to earn interest on their crypto assets by lending them to borrowers, with the option to receive interest payments in stablecoins.

Curve: An exchange that focuses on providing stablecoin liquidity, allowing users to trade between different stablecoins with low slippage and high liquidity.

dYdX: A platform for margin trading and derivatives, offering the ability to trade and take out loans using stablecoins.

Insurance and risk management: Users can purchase decentralised insurance to protect against certain types of risks, such as the loss of private keys or the failure of a smart contract.

Uniswap: An exchange that enables users to trade cryptocurrencies and tokens in a decentralised manner.

Aave: A lending platform that allows users to earn interest on their crypto assets by lending them to borrowers.

MakerDAO: A decentralised platform that allows users to take out loans using their cryptocurrencies as collateral.

Compound: It is a lending and borrowing platform where users can earn interest on their crypto assets or borrow against them.

Curve: An exchange that focuses on providing stable coin liquidity.

Yield farming and liquidity mining: Users can earn interest or rewards for providing liquidity to specific pools or protocols and many more, as the market is still young and new use cases are being discovered regularly.

Uniswap: An exchange that enables users to provide liquidity to the platform in exchange for UNI tokens and trading fees.

Aave: A decentralised lending platform that allows users to earn rewards for providing liquidity to the platform, with the option to receive interest payments in stablecoins or other cryptocurrencies.

Compound: Lending and borrowing platform where users can earn interest on their crypto assets or borrow against them, with the option to receive interest payments in stablecoins or other cryptocurrencies.

Balancer: A decentralised exchange that allows users to provide liquidity to the platform in exchange for BAL tokens and trading fees.

Curve: Exchange that focuses on providing stablecoin liquidity, allowing users to trade between different stablecoins with low slippage and high liquidity, and to earn rewards for providing liquidity to the platform.

Technical stack to create DeFi apps

To create decentralised finance (DeFi) applications, a developer typically uses a combination of blockchain technology, smart contract platforms, and decentralised storage solutions. Some popular choices include:

Blockchain Platforms:

Ethereum is currently the most widely used blockchain for DeFi development, but other options such as Binance Smart Chain, Polygon, and Solana are gaining popularity.

Ethereum: It is the most popular and trustable Blockchain for development where transaction history is visible for the users to claim and prove their ownership easily. Ethereum blockchain rarely goes down and is one of the favourite platforms for users to build on DeFi apps.

Polygon: It is a layer-2 Blockchain and works on proof of stake. It is used as the Blockchain platform for DeFi app development.

Flow: It is a decentralised blockchain designed for creating various DeFi apps using a Cadence programming language.

Tezos: It is an open-source blockchain open for its users and developers to make new changes and has a significant scope of research and development. It uses a pre-compiled FA2 NFT contract written in LIGO Smart contract language.

Smart contract platforms:

Ethereum's smart contract platform is called Solidity, and it is used to create and deploy smart contracts on the Ethereum blockchain. Other platforms such as Truffle, Embark, and OpenZeppelin can also be used to help manage and test smart contracts.

Decentralised storage:

Interplanetary File System (IPFS) and Swarm are two decentralised storage solutions that can be used to store and access data on a decentralised network.

IPFS: It is a peer-to-peer hypermedia protocol through which we can store the media content in a decentralised manner giving stress to the security aspect of the storage system.

Filecoin: We can store critical information like media files in a decentralised manner with the help of Filecoin. Users can get effortlessly comfortable with this cloud-based service of Filecoin, which provides the developers with all the necessary features of DeFi apps creation.

Pinata: It is a popular platform for uploading and managing files on IPFS and provides users with secure and verifiable files.

Development tools:

Developers also use a variety of development tools such as web3.js and web3.py to interact with the blockchain and smart contracts, as well as development environments like Truffle Suite, OpenZeppelin, and Embark to deploy and test smart contracts.

Back end:

NodeJS

ExpressJS

Java

GO

Front-end Frameworks:

React.js and Angular.js are popular front-end frameworks that can be used to build user-friendly interfaces for DeFi applications.

React

Angular

Vue

Bootstrap

Databases:

PostgreSQL

MySQL

NoSQL: MongoDB

It's important to note that the DeFi ecosystem is constantly evolving and new tools and technologies are emerging all the time. Developers should stay informed about new developments and be prepared to adapt their technical stack as needed.

Cost to create a decentralised financial platform

The cost of creating a DeFi app depends on several factors such as the complexity of the app, the team size, the platform and technology used, and the geographical location of the development team.

For a basic DeFi app, the cost could range anywhere from $10,000 to $50,000. However, if the app requires more complex features, the cost could go up to $100,000 or more.

It's also worth considering that the development cost is just one part of the overall budget. Other costs such as marketing, legal and security expenses should also be taken into account.

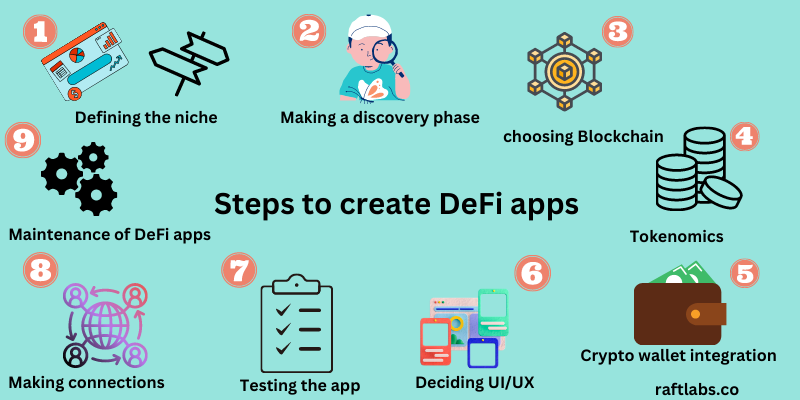

Steps to create DeFi apps:

Important steps to create a DeFi app

After researching and assessing the recent developments, we have come across several technologies and strategies that create profound DeFi applications with user friendly interfaces.

Defining the niche of DeFi app:

Before going to the actual development, we need to define the DeFi app archetype that the customer wants for his application. We need to have an overview of different types of DeFi apps available in the market and which ones are the most popular. Choosing the DeFi app is necessary based on your business goals and objectives.

Making a discovery phase:

The discovery phase of creating a DeFi app involves researching and understanding the market demand and competition in the DeFi space.

Identifying the pain points or gaps in the current DeFi ecosystem that your app can address is really important. Based on your research, define the minimum set of features that your DeFi app must have to solve the problem and meet the needs of the target audience. Developers should create a high-level roadmap for the development of the DeFi app, including the timeline, milestones, and budget.

Choosing a Blockchain

When choosing a blockchain for DeFi (Decentralised Finance) applications, consider the following factors:

- Security: The blockchain should have a strong security track record, with a decentralised consensus mechanism that is resistant to 51% attacks.

- Scalability: DeFi applications require high transaction throughput, so the blockchain should have good scalability features to support a large number of users and transactions.

- Interoperability: The blockchain should have good interoperability with other blockchains, allowing for seamless transfer of assets and data between different networks.

- Developer support: A strong and active developer community is important for ensuring that the blockchain can support new DeFi applications and evolve over time.

- Cost: DeFi applications often involve small transactions with high frequency, so the cost of using the blockchain should be reasonable and predictable.

- Regulation: The regulatory environment for DeFi applications is still evolving, so it's important to choose a blockchain that is compliant with current and future regulations.

Based on these considerations, some of the most popular blockchains for DeFi include Ethereum, Binance Smart Chain (BSC), and Polygon (formerly known as Matic Network).

Choosing Tokenomics for your DeFi app

The token distribution should be fair and transparent, with a clear plan for how new tokens will be created and distributed.It should have a clear use case and utility within the DeFi application, such as providing access to certain services or serving as a means of payment or collateral.

The token economics should incentivize users to participate in and contribute to the DeFi ecosystem, such as through staking, liquidity provision, or governance. It should be stable and not subject to excessive volatility, as this can undermine the usefulness of the token within the DeFi application.

Crypto wallet Integration

Integrating crypto wallets in DeFi applications is a crucial aspect to ensure that users have secure and seamless access to their assets and can participate in DeFi activities such as trading, borrowing, and lending.

Always ensure that the integration follows best practices for security, such as implementing proper key management and encryption to protect users' assets. Some popular crypto wallet providers that are commonly integrated with DeFi apps include MetaMask, Gnosis Safe, and Argent.

Oracle providers

Oracles are essential components in many Decentralised Finance applications, as they bring external data into the blockchain and allow smart contracts to access real-world information.

Here are a few steps to consider when using oracles in DeFi apps:

- Determine the data source: Determine what external data is needed for the DeFi application, such as market prices, exchange rates, or weather data.

- Choose an oracle provider: Choose a reputable and reliable oracle provider that can securely and accurately provide the required data.

- Integration with the smart contract: Integrate the oracle into the DeFi app's smart contract, allowing it to access the external data and execute its logic based on that data.

- Implement security measures: Implement security measures to protect against oracle failures or malicious attacks, such as using multiple oracles for data verification or implementing a dispute resolution mechanism.

- Testing: Thoroughly test the oracle integration to ensure that it is working as intended and that the smart contract is able to access the external data accurately and securely.

- Maintenance: Regularly monitor and maintain the oracle integration to ensure that it continues to work properly and that security measures are up to date.

Some popular oracle providers in the DeFi space include Chainlink, Band Protocol, and Tellor.

Deciding UI/UX of DeFi app

Next, we need to work on the UI and UX of the site. An attractive and user-friendly interface will invite many people to the platform and increase traffic. Developers need to work on the frontend part of things, where they will decide the look and feel of the DeFi app and how various icons and transactions will be presented to the users.

Testing the App:

We need to have QA testers find any bugs in the app and fix them before our decentralized platform is released. This ensures that the best product is served to the customer. The applications should meet the basic requirements, have no bugs and errors, and perform well under different conditions.

Making connections:

Lastly, building a healthy community of buyers and bidders is essential for smoother marketplace functioning. The NFTs and the digital assets should be competitive enough for the people to choose your marketplace before going to any other platform to buy them.

Maintenance of the DeFi app:

It is essential to maintain the app after it is launched. You should fix the bugs from time to time and keep adding new features to enhance the working of your platform. Security should be the topmost priority to secure the assets of the buyers and sellers there. It is an ongoing process where you need to constantly work on the functionality, performance, and scalability of the performance of the decentralised finance app.

Conclusion

In conclusion, DeFi (Decentralized Finance) apps are changing the financial landscape by providing a more accessible and open financial system. These apps use blockchain technology to offer financial services such as lending, borrowing, trading, and more, without the need for intermediaries. DeFi apps have the potential to disrupt traditional finance and provide financial freedom to people around the world.

RaftLabs provide excellent services to develop an extensive and user friendly interface for your app using the latest technologies and services. Customers can save their time while building DeFi apps with our help and can get consulting services from our experts